This site is for people who want the facts of what is going on with the economy: how & why we got here. If you are looking for a 10-word soundbite blaming one party or politician, this is not the site for you.

How we got here

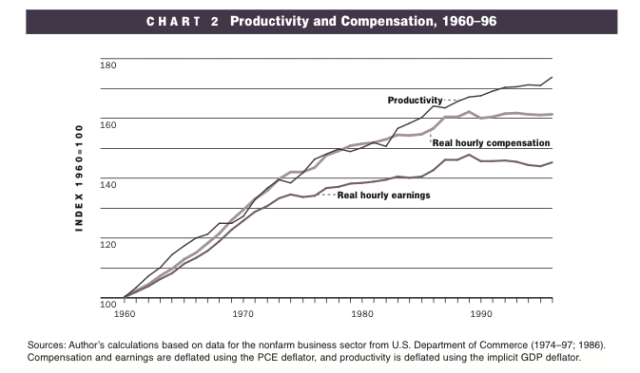

In the 1960s, many, if not most, American families could subsist on one income: the father worked, and the mother raised the children. As productivity (GDP) increased, wages went up with it. Starting in the mid-1970s, that began to change:

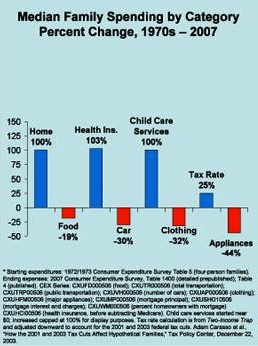

Meanwhile, costs of necessities such as housing and health care have dramatically increased in that time span.

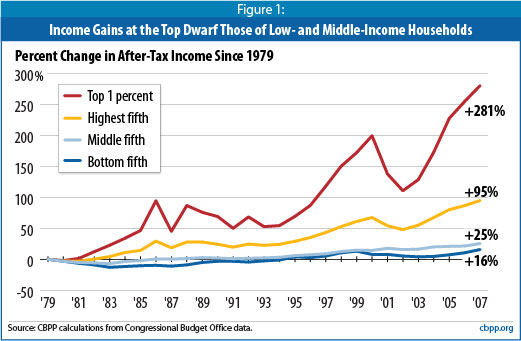

So you have statistically flat wages, skyrocketing costs housing/health care/child care, and on top of that, a new trend of employers sending American jobs to cheap labor markets (with the help of favorable legislation in Washington). Over the course of over 30 years, this has put a very big squeeze on the middle class, and changed the fundamental distribution of wealth in the United States.

Okay, enough with the graphs… who is to blame?

That is a complicated question. In the 1960s, unions wielded a lot of power and influence (perhaps too much so), and starting in the 1970s, that all began to change. Meanwhile, corporate lobbying skyrocketed, and over the course of many years, Congress passed laws that allowed large corporations to run wild.

Example: in 1995, the assets of the six largest banks in the US added up to 17% of GDP. Today, the assets of the six largest banks amount to a whopping 63% of GDP.

So, during the late 90s & 2000s, you had huge financial institutions becoming more powerful, controlling vast amounts of capital. And to make matters worse, in 1999, Congress passed a law effectively repealing The Glass-Steagall Act, which was enacted in 1933 to put a “wall” between depository banks (who have your checking accounts) and investment banks (who basically make money by taking risks with money).

Starting in 2000, these banks could operate together, forming huge, complex institutions where they could use their vast resources to take massive risks on things such as housing. This is what eventually led to the global economic collapse in 2008, which is explained very nicely here.

So, if you’re looking to assign blame, you’ve got a long list. But truly, it’s mostly about corporations spending crazy amounts of money to essentially “buy” members of Congress. This affects both major parties, and you have to look very hard to find politicians who are not on the take. Meanwhile much of America is consumed with the old “liberal vs. conservative” argument, when in reality, it’s us vs. the corporations. There are members of both parties who have pointed this out, such as Republican Ron Paul, and Democrat Bernie Sanders.

Too many of our citizens are being strung along by the crazy notion that our current economic woes are the fault of 1 person — be it Obama or Bush. The reality is that our current mess was created over decades. The huge shift in power away from labor in the 70s and 80s, the laws written to help corporations send jobs to cheap labor markets in the 90s and 00s, and the banking regulations gutted in the 90s and 00s all played a part.

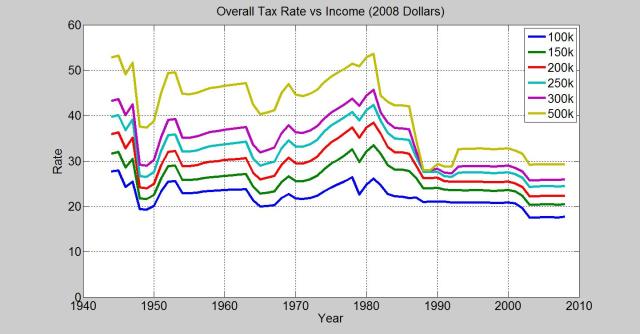

Federal income tax rates today are at historic lows. Consider, just 2 generations ago, the top tax rate was over 70%!

Very few, if any, politicians have expressed a desire to increase tax rates on any group. However, the very highest wage earners, as you can see above, have benefited disproportionately in the past 30 years or so.

Given the commitments the US has made (2 wars, prescription drugs for seniors, etc), and the ongoing lag in recovery from the worst recession since the Great Depression, we’re in a position where there is no real way, mathematically, to get a handle on our debt situation without BOTH cuts and additional revenue. A generation ago, this could be accomplished a variety of ways because we had a strong middle class. Today, over 50% of working Americans pay no income tax at all, primarily because income and wealth has been trending upward for decades.

This is one of the few areas where there is less misinformation. Deficit spending, which has been all too common, particularly since the 1980s, has skyrocketed since the economic crash in 2008.

There is no question that this is not sustainable. One thing to bear in mind, however, is that many economists would say that government spending is one way to stimulate the economy during difficult times. Some studies have suggested that this increased spending stopped “The Great Recession” from being worse than it was.

There is, however, no question that this must change or we face severe consequences in later years. Greece, for example, recently went through a severe debt crisis. For us to avoid this, we have got to reverse recent trends, but it is very much a “chicken or egg” argument, because until the economy improves, it is difficult for government to pay down debt.